The financial markets are constantly evolving, and we take pride

in always being part of these transformations. Evolving with

the market is our tradition. That's why one of our most solid assets

is our legacy, which fosters results in the present and future,

generating value across generations.

In the wake of the great technological transformations brought about by the Industrial Revolution, the global economy was reconfigured throughout the 19th century. Financial institutions, once merely depositories, became companies that traded currencies, precious metals, issued promissory notes and financed a variety of projects.

It was in this environment that the Safra family established the basis of the contemporary financial system in the Middle East, stimulating and financing the emerging industrial, transport and communication infrastructure, and trade in raw materials, agricultural and industrialized products between nations.

During this period, the city of Aleppo emerged as one of the main centers of trade in the Mediterranean. The home of the Safra family at the time, Aleppo is in northwest Syria and served as a trading post for merchants. The cosmopolitan family financed the region's trade caravans and traded in different currencies, as well as silver and gold. It was in this context that the Safra family prospered and made a name for itself, to the point where their surname became the Arabic word for the color of the precious metal: Safra.

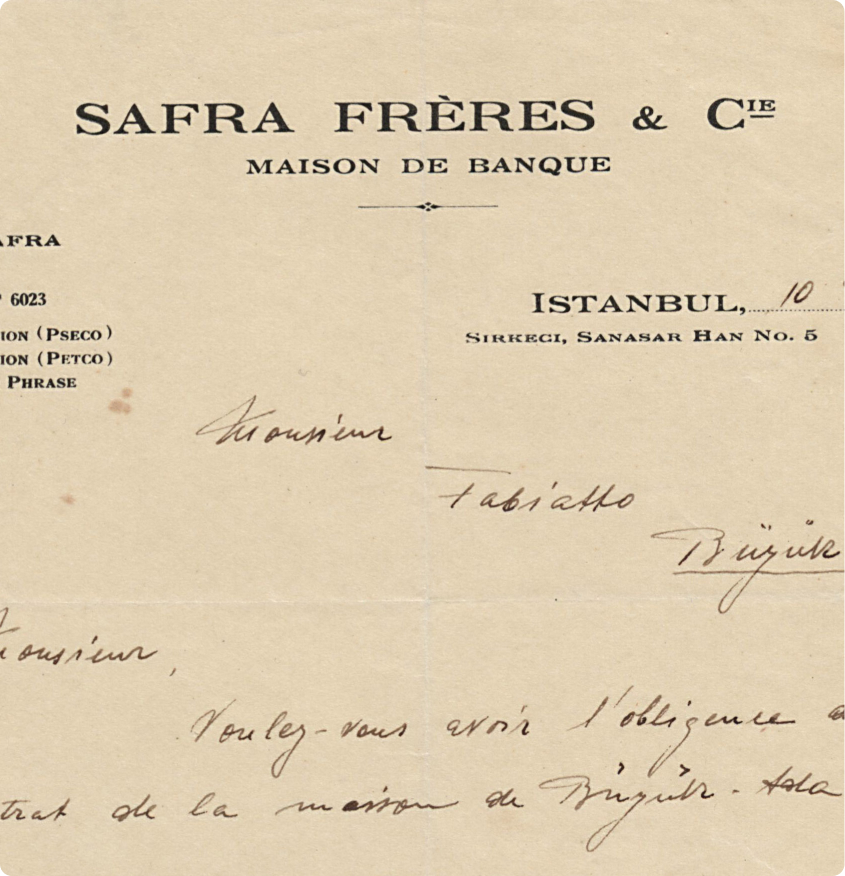

In 1840, the Safra family founded Safra Frères Et Cie, with headquarters in Aleppo and offices in the Ottoman capital, Istanbul, and in the Egyptian city of Alexandria. The financial institution, which quickly gained fame and prestige in the Mediterranean countries, had among its partners the brothers Ezra and Elie Safra, the latter the father of Jacob Safra, who would become the patriarch of the family. Jacob was born in 1891. At the age of 13, after losing his father, he was taken in by his uncle Ezra. As a teenager, Jacob was a brilliant young man, with the ability to mentally calculate the complex conversion of different currencies into their gold and silver equivalents. This ability brought him notoriety among the region's merchants. Seeing his nephew's talent and passion for the family business, Ezra prepared Jacob for a new challenge.

With the collapse of the Ottoman Empire in the First World War, the flow of trade through Aleppo dwindled. To preserve the family business, Ezra Safra chose his young nephew as a partner and assigned him to open and manage a new branch of Safra Frères in Beirut, Lebanon.

Already in Beirut, Jacob longed to build his own business. In 1920, he decided to open his own financial institution, the Jacob E. Safra Bank. The new company prospered quickly, serving many of the region's wealthy merchants. It was in this environment that Jacob Safra raised his family of eight children, among them those who would become famous market financiers, pillars of the Jewish community around the globe, the brothers Edmond, Moise and Joseph Safra. The creation of the State of Israel and the beginning of the new country's conflicts with its neighbors made the environment for Jews in the Middle East unstable. Although Lebanon remained reasonably safe for Jews, Jacob Safra decided to leave the country for Latin America. In 1952, Jacob Safra settled in São Paulo, a city that was experiencing prosperity and political stability, as well as being home to a large Syrian-Lebanese Jewish colony.

When the patriarch died in 1963, Edmond, Moise and Joseph Safra took over the operation and followed the family's vocation and expertise in the financial market. The brothers took the business to a new level, building a global financial empire, present in the Americas, Europe, Asia and the Middle East. Joseph Safra, Alberto Safra's father, was celebrated by the market as one of the greatest financiers of his generation, considered a risk-averse investor and a relentless worker.

To preserve this legacy for generations, Joseph Safra directed his children to work in the financial market, as well as passing on to them the importance of philanthropy in various areas. Alberto Safra, after completing his studies at Wharton, was sent by his father to work in the family business, where he demonstrated the talent inherited from his ancestors in the financial market, in the constant search for return and the ability to identify risk and react with agility. Today, like his predecessors, Alberto Safra uses his financial institution, ASA, to follow his family's tradition in the global financial market, generating value across generations.

Usamos dados pessoais e cookies para analisar o uso de nosso site, direcionar conteúdos e anúncios personalizados e aprimorar a sua experiência. Ao continuar navegando, você concorda com a nossa política de privacidade e política de cookies.

The information contained in this website is for informational purposes only and does not constitute an investment recommendation or offer of investment funds or any securities by ASA.

ASA Asset 2 Gestão de Recursos LTDA. ("ASA") is duly authorized by the Comissão de Valores Mobiliários to carry out the activity of managing securities portfolios in the "asset manager" category, to distribute shares of the investment funds under its management, and to conduct the activity of coordinating public offerings. This website also contains a link to the page of third-party distributors duly contracted by the investment funds under management. The information, materials or documents made available here do not characterize and should not be understood as an investment recommendation, analysis of a security, promotional material, participation in any business strategy, solicitation/offer/sales effort or distribution of investment fund shares. indicated here. The information and materials do not constitute legal, accounting, regulatory, tax or any other advice in relation to investment alternatives and/or various matters contained in the documents. ASA is not responsible for errors, omissions or inaccuracies in the content of the information disclosed, nor for investment decisions made based on this website, either by the investor or by professionals consulted and/or contracted by him. Some of the information contained herein may have been obtained from market sources. Even with all the care taken in its collection and handling, ASA is not responsible for the accidental publication of incorrect data, or for any other errors, omissions or the use of such information. The information, materials or documents provided herein are for informational purposes only and do not consider investment objectives, financial situation or individual and particular needs of each investor, in addition to not containing all the information that a potential investor should consider or analyze before investing in an investment fund. Investors are advised to carefully read the regulations and other fund documents before investing. Investors should always base themselves exclusively on their opinion and on the opinion of specialized professionals hired by them to give their opinion and decide on the investments that best fit their profile, taking into account, above all, the applicable risks and costs. Investment funds may use derivative strategies as an integral part of their investment policy. Such strategies, in the way they are adopted, can result in significant equity losses for their shareholders, and may even lead to losses greater than the capital invested and the consequent obligation of the shareholder to provide additional resources to cover the fund's loss. Investment funds are not guaranteed by the fund manager, the portfolio manager, the custodian or any insurance mechanism or by the Fundo Garantidor de Créditos – FGC. There is no promise or guarantee of performance, and any reference to past or historical profitability does not represent a guarantee of future profitability. Returns are net of expenses, administration and performance fees and taxes. Some of the funds have less than 12 (twelve) months since launch. In order to evaluate the performance of a Fund, it is recommended to analyze at least 12 (twelve) months.

ASA is a foreign exchange correspondent of Ebury Bank, under the terms of Resolution No. 4935/2021 of the Central Bank of Brazil (BACEN). For more information about our partner, available services, customer service and ombudsman, visit the following link: https://br.ebury.com/